Title loans in Tempe, offer a unique and convenient way for borrowers to access cash quickly. Unlike other unsecured loans, title loans do not require a credit check or qualifying process. Instead, you only need to prove that you own the vehicle used as collateral on the loan. The car has to be titled in your name, and the vehicle must be worth more than $3,000 to qualify.

Your credit score is irrelevant when getting a title loan. In fact, some customers with FICO scores under 500 can be approved for a secured loan! as long as you own your car outright and can provide proof of ownership, you will likely be approved for a title loan.

Requirements For Title Loans In Tempe, AZ

Unlike other types of loans, a title loan in Tempe, AZ requires no credit check or qualifying process. The only requirements you will need to meet are relatively simple, and most borrowers can qualify for same day approval without much of a credit check as long as they have a few things:

You must own your vehicle outright, and the car or truck can’t currently be registered under any liens or leases. We cannot offer a title loan if you have an outstanding balance on your vehicle’s lien or leaseholder. You must be able to provide proof of ownership for your car or truck.

Loan Amounts And APR For Auto Title Loans In Tempe, Arizona

Title loans in Tempe, Arizona are unique among other lending products because they allow you to borrow up to the full market value of your vehicle. While some lenders may only offer a small portion of this amount, like $1,000 or less for cars that cost less than $5,000, we tend to see title loans in Tempe ranging from as low as $1,000 up to $50,000 depending on your ability to make payments and our lender’s risk assessment.

The length of time that it takes to pay back a title loan in Tempe will vary by how much money is borrowed and how often payments are made. Most people who take out loans will make bi-weekly or monthly payments on their loans over several months, but some may choose to extend this by making weekly or even daily payments if they have the ability. Generally speaking, most car title loans are paid off within three months to two years, and it makes financial sense to pay off the loan early to save money and avoid getting deeper into debt.

Tempe, AZ Title Loan Restrictions

The state of Arizona has some specific restrictions on the types of lending products that are offered in Tempe. Still, car title loans and cash advances both exist somewhat legally, thanks to loopholes created by the state legislature. While these laws may have been implemented with good intentions to protect consumers from shady financial practices, they can also limit your ability to get a fair loan. For example, our lenders are prohibited from charging more than $15 per $100 borrowed or 36% APR for any fees associated with your auto title loan, whether for late payments or administrative costs.

Another key area of concern shown in the law is that these products cannot be offered by a loan broker and they must instead be made through a licensed lender. This requirement means that you will not have to deal with third parties who may try to take advantage of you to receive some commission, but it also limits your ability to shop around for the best title loans in Tempe, Arizona. While this regulation is intended to help protect consumers, many dishonest lenders may still be trying new tactics to get a license despite their intentions. Hence, we encourage anyone looking into these kinds of loans to carefully research beforehand.

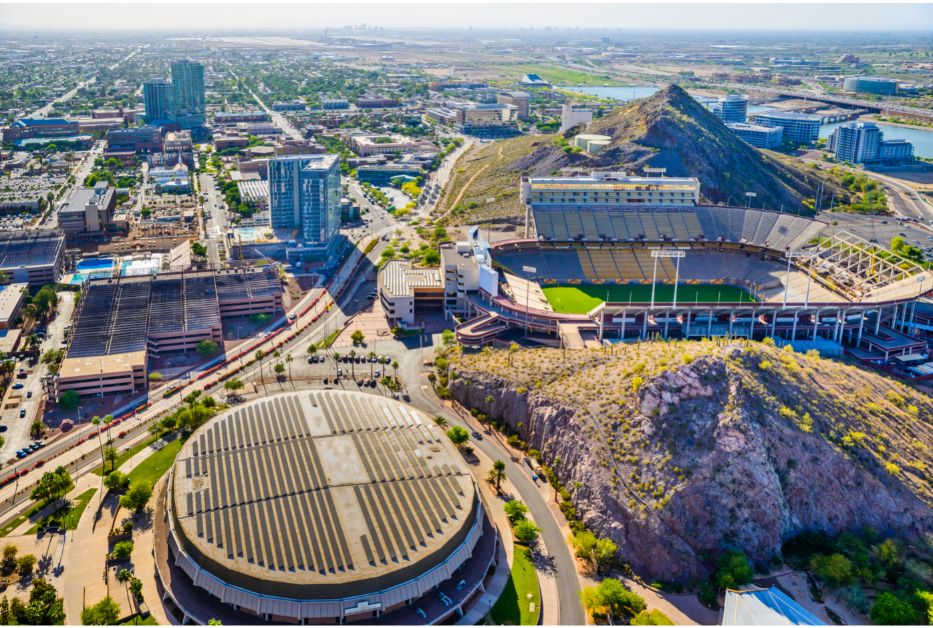

Tempe Location And Finding A Direct Title Loan Lender Near Me

We work with many residents in the Tempe, Arizona area who are looking for title loans for emergencies but also to help them make ends meet. With our direct lending options, we can usually guarantee that the funds will be available within an hour or two after submitting your application online so that you don’t have to wait around all day while they process everything.

Once approved, borrowers will come down for a quick inspection at a local office in Tempe, or you can also get this done with a title loan lender in Phoenix. The entire process is simple and we can take your application online and assemble a quick calculation and lending estimate within a few hours. So contact us anytime to see how much you can get with a secured loan!